What To Know About Tax Liens

A tax lien is a form of adverse, or involuntary, lien. An adverse lien describes one person or entitys right to possess someone elses property, until the debtor can pay off a debt he/she owes to the creditor. If the federal government places a tax lien on your property, the government will have possession of this property until you can pay off your tax debt. This means you cannot sell or discharge the property until you satisfy your debt. If you do choose to sell, money from the proceeds will go to the IRS to repay your debt. When you pay off your tax debt, the county will release the lien.

You will still have the right to use your property with a lien against it, but the government will technically hold the property and property rights. The government can place a tax lien on your wages, bank accounts, accounts receivable, vehicle, home, business, valuables, and other types of property. In Texas, the IRS can place a lien on your primary residence, but it cannot seize this type of property. Texas codes protect primary residence seizures. If the IRS places a tax lien on your homestead and you sell this property, you have six months to put the proceeds from the sale into a new primary residence. If you fail to do so by the deadline, the government can use the proceeds to satisfy your tax debt.

Do Tax Liens Show Up On Credit Karma

While tax liens no longer show up on your credit reports, you should prioritize paying off a tax lien to avoid the repossession of your property by the government. Keep in mind that you typically dont have to pay back all the money owed in one big payment.

Does The Irs Report To Credit Bureaus

The IRS does not report your tax debt directly to consumer credit bureaus now or in the past. In fact, laws protect your tax return information from disclosure by the IRS to third parties . However, once a Notice of Federal Tax Lien has been filed, your debt becomes public record. Before the credit bureaus changed their policies in April 2018, the public nature of the lien allowed it to be reported on your credit report.

Although these agencies will no longer show tax liens on credit reports, a tax lien filed against you may still be discovered by lenders, credit card companies, etc. In addition to making it difficult to get new credit cards or loans, landlords or employers also may view the tax lien, which may have its own negative effects.

The IRS generally keeps the tax lien in place until you pay your taxes in full or have made other arrangements to pay off, reduce, or eliminate the debt and the IRS releases the lien.

You May Like: How Do You Raise Your Credit Score

How To Prevent A Tax Lien

You can prevent the IRS from filing a federal tax lien against you if you’re able to pay the tax in full before the lien is filed. You can also prevent a lien by setting up a payment plan or installment agreement with the IRS if you’re unable to do pay the tax debt in full in a single lump sum. It really just wants you to address your debt rather than ignore it.

How A Tax Lien Affects Your Credit Report

A tax lien can have a long-term negative impact on your credit score, which can make it difficult to buy a home, borrow money for school, or achieve other goals.

It is very important to learn how to remove a state tax lien from your credit report. If you are unable to pay your tax lien, the damage to your credit score will be permanent.

Tax liens are one of the few credit issues that do not have to be deleted from your credit report. This is according on the Fair Credit Reporting Act. As a result, you should try to avoid having a tax lien on your record.

Read Also: Is 600 A Bad Credit Score

The Length Of A Tax Lien

A federal tax lien is self-releasing. That means when ten years passes, it automatically expires. This provision is contained directly in the language of the lien:

IMPORTANT RELEASE INFORMATION: For each assessment listed below, unless the lien is refiled by the date given in column , this notice shall, on the day following such date, operate as a certificate of release as defined in IRC 6325.

However, few taxpayers opt to wait out the statute of limitations. If you purchase property or earn money during that 10-year period, it can be seized by the IRS to repay the debt. A tax lien also makes it very difficult to get credit, including mortgages and other types of loans.

If you take steps to resolve your back taxes, such as submitting an offer in compromise to settle your account for less than you owe, appealing an IRS decision, or enrolling in an installment agreement, the expiration date on your debt is extended. If this occurs, the IRS can refile your lien within 30 days of the original expiration date and it will last until the new expiration date.

Also Check: Can A Bank Reopen A Charged Off Bank Account

A Federal Tax Lien On Credit Reports

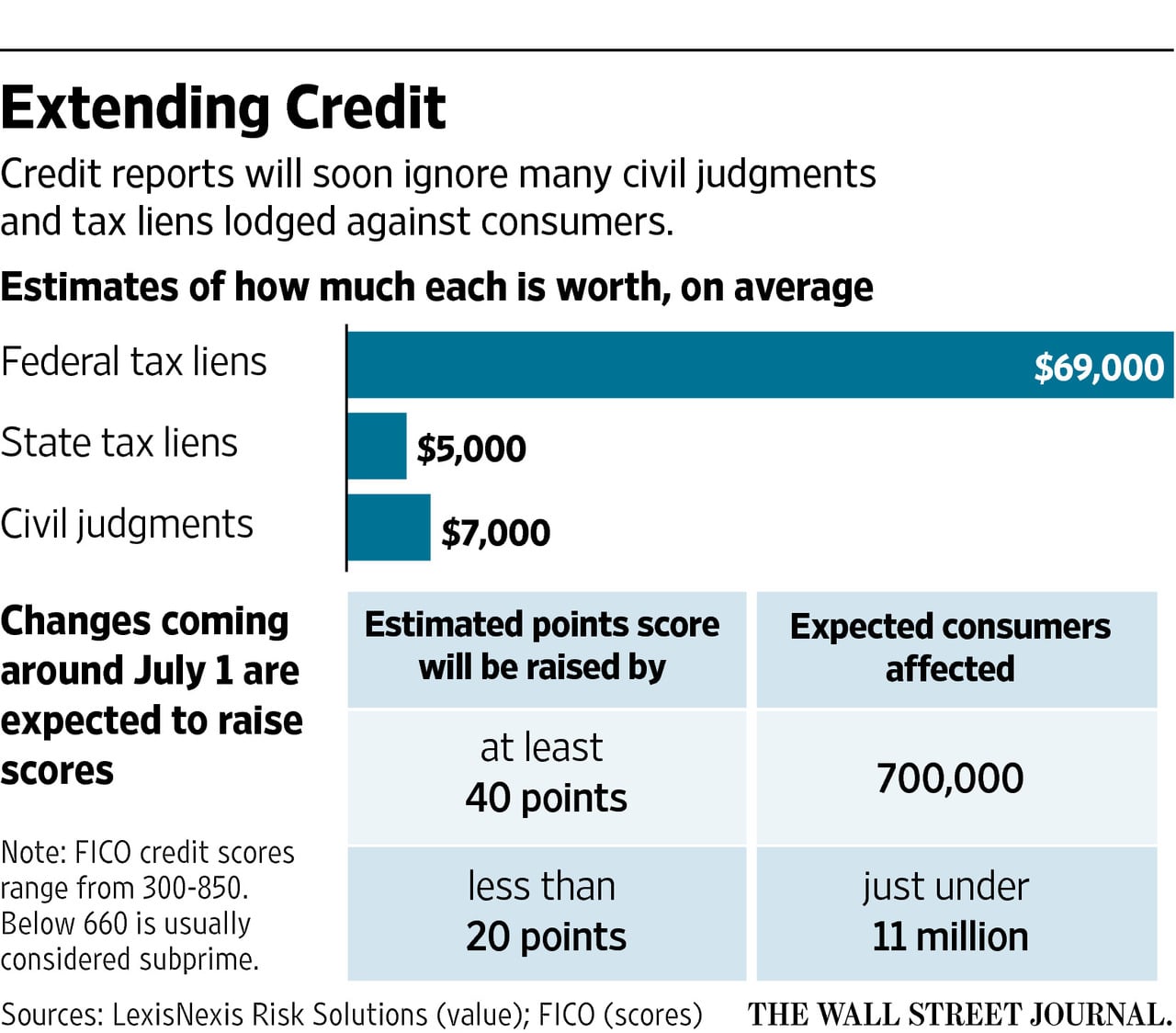

Currently, tax liens no longer have a concrete effect on your credit score. This is due to a recent change made in 2017 and 2018, when the three national credit bureaus removed tax liens from credit reports, and changed the rules so that federal tax liens wouldnt be automatically taken into account when calculating a consumers credit score.

These changes were made after a study by the Consumer Financial Protection Bureau found that reporting issues too often led civil judgments and tax liens to be linked to the wrong person, and that these reporting issues had detrimental effects on consumers with an otherwise good credit score.

Prior to this change, tax liens would remain on a credit report for up to seven years even if paid, and ten years if unpaid, negatively affecting their score by up to three figures .

Also Check: How To Find Out Credit Score For Free

What To Consider Before Giving Money For Law Or Medical School

Dear Liz: Our daughter is in medical school using scholarships and student loans. We are now in a position to help her out, but worry that financial help might work against her sources of aid. Would it be better to pay some on her outstanding loans, give her money, pay some of her living expenses or put the money into a savings account to give her when she graduates to use towards paying down her debt? The amount we could give her would not be enough to pay for everything each semester, just something to ease her burden. We dont want to jeopardize her ability to receive aid.

Answer: While nearly all graduate students qualify as independent which means that parent financial information isnt required to get aid some medical and law schools do consider parental assets and income in their calculations.

Your daughter should call her schools financial aid office anonymously to ask about its policy regarding parental aid, said Lynn OShaughnessy, a college financing expert at TheCollegeSolution.com. If your help would hurt, you can use the savings account route but you neednt wait until she graduates to give her the money. Once she files financial aid forms for her last year, she should be able to accept your largesse without consequence.

How Long Does A Levy Last

The IRS can seize your assets as long as you owe any part of a tax debt and the ten-year statute of limitations on collections has not expired. Generally, levies are one-shot affairs the government must prepare and send a new levy notice every time it wants to grab something .

Example: The IRS levies Remingtons account at Piker Bank on Monday. After a 21-day holding period, the bank must send to the IRS everything in Remingtons account on the day of the levy notice. If the balance is $0, then the IRS gets nothing from Piker. If Remington deposits $150,000 on Tuesday, the day after the notice, the IRS cant touch it without sending a new levy notice. If Piker Bank sends the IRS anything from Tuesdays deposit without having received another levy notice, it will have to repay Remington the amount it sends the IRS.

Independent Contractors and Employees: As long as you work for the same employer, it must continuously withhold a portion of each paycheck for the IRS. This rule also now applies to independent contractors. The IRS can intercept funds owed to a self-employed person from a business.

Dont Miss: Does Speedy Cash Do Credit Checks

Recommended Reading: Does Changing My Name Affect My Credit Rating

How To Remove A Tax Lien From Your Credit Report: 3 Steps

A government lien against your personal property for failure to pay a tax debt is a serious matter â one that could have major consequences if you donât deal with it promptly.

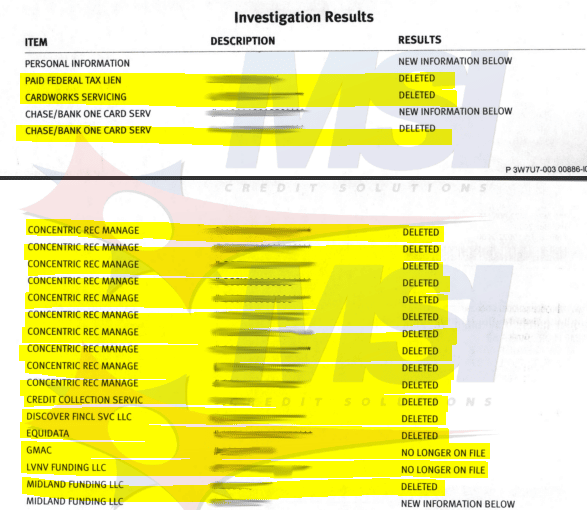

Fortunately, there are actions you can take to fix the problem. You can remove federal income tax liens from your credit reports by paying off your tax debt, submitting a withdrawal form to the Internal Revenue Service and waiting for the IRS to respond.

How Do I Avoid An Irs Tax Lien

You can avoid a federal tax lien by simply filing and paying all your taxes in full and on time. If you cant file or pay on time, dont ignore the letters or correspondence you get from the IRS. If you cant pay the full amount you owe, payment options are available to help you settle your tax debt over time.

Recommended Reading: Is 779 A Good Credit Score

When Will Tax Liens Be Removed From My Credit Report

A tax lien can appear on your credit report for as long as ten years, which is a very long time. The average time that a tax lien can appear is seven to ten years after filing.

With this, you can imagine how extremely damaging unpaid tax liens could do to your credit report. The best-case scenario for this situation is to pay the tax and interests immediately.

On rare chances, credit bureaus can remove your unpaid tax lien on your records if left unpaid after ten years. But this is not always the case. So its still best to avoid tax liens as much as possible.

The paid tax liens are removed after seven years in your credit report, given that youve already paid it with all the interest fees and penalties.

If a paid tax lien still appears in your credit report after seven years, you just need to file for a dispute to credit bureaus. They will verify its status and remove it within 30 days upon verification.

Change #: Reporting Rules For Public Records

The first update happened in July 2017 when the criteria for tax liens and civil judgments appearing on consumer credit reports changed. This update is part of the National Consumer Assistance Plan initiative the three major credit bureaus originally announced in 2015. The goal is to make credit reports more accurate and make it easier for consumers to correct errors.

There were various components of the NCAP that rolled out at different times. This particular update meant that beginning July 1, 2017, all civil public records require the inclusion of a name, address, and a Social Security number or date of birth before appearing on credit records from the three major credit reporting companies. The credit bureaus were also required to refresh the information at least every 90 days. So, if the public records data didnt meet these criteria, they could no longer be included on a credit report.

You May Like: How To Remove Bad Debt From Credit Report

Can A Creditor Put A Lien On My Property

Yes, a on your real estate if you do not repay your debt. Of course, you must be a property owner. However, before they can obtain a lien, the creditor must get a judgment against you. This means they must go to court. The judge must rule that you owe money and the creditor has the right to collect it from you. At this point, the creditor can put a lien on your home or other assets.

How Do Tax Liens Work In Canada

In Canada, were able to have a lot of public resources because of our taxation system. The Canada Revenue Agency oversees taxation. If a taxpayer, which could be an individual or business, doesnt pay their debt, the CRA is responsible for collecting it. A tax lien may arise if you fail to pay your tax bill. In this guide, you can learn more about tax liens and what to do if you find a lien attached to your property.

Don’t Miss: How To Take Freeze Off Credit Report

Why Clients Prefer Taxlane

At TaxLane, we represent clients with both federal and state tax matters. We work to resolve your individual and business tax matters with a sense of urgency. We understand how important it is to get back on the path of financial freedom.

Acting quickly, we work to resolve your tax issues with the best outcome for your unique situation. In fact, TaxLane proudly serves clients across the United States.

Lean on a trusted tax professional to mitigate the severe financial repercussions of ignoring or not properly managing your IRS issues by contacting TaxLane to schedule a consultation today!

What Is A Lien

A lien is non-possessory security interest on a piece of property. There can be several different kinds of liens placed on a property, each indicating the entity or individual with the interest. In some cases, they have the legal right to sell your property in order to recoup the debt or foreclose on you.

Read Also:

Recommended Reading: How To Get Credit Report Mailed To You

How Does A Lien Affect Me

Since most tax liens exist on homes, there is a chance you could lose your property. However, the CRAs intention is not to make people homeless. There are many steps before seizing and selling a property to cover tax debt. To avoid losing your home, its best to communicate with the CRA and determine a way to settle your tax debt. If the CRA puts a tax lien on property other than your home, youre at risk of losing those assets too.

How Can A Tax Lien Affect Me

Tax liens can affect your ability to sell your property or buy new property. For example, if you want to sell or refinance your property, you must pay off the tax lien to get a clear title. Tax liens are listed on your credit report and lower your credit rating, which may affect your ability to get loans or financing. A tax lien is valid for seven years unless a continuation is filed before it expires. The continuation extends the lien another seven years. Mississippi law allows continuations on state liens until theyre paid in full so continuations can be filed repeatedly making a tax lien valid indefinitely.

Read Also: How To View My Credit Score

Apply For Withdrawal Of Lien

Under the Commissioners 2011 Fresh Start initiative, which aims to help struggling taxpayers, you may be eligible for a tax lien withdrawal. It means that the government will remove the public notice of your tax lien and it will no longer compete with other creditors claims to your property. However, you still owe and must pay the tax debt.

General qualifications include the following:

- Youve filed diligently all your tax returns over the past three years

- Your tax payments and federal tax deposits are updated and current

Take Care Of Your Tax Debt

To put it gently, the IRS and state and local governments tend to frown upon unpaid taxes. Its to your advantage to pay any taxes you owe. A tax lien can be removed when the taxpayer and the government agree to a payment plan, like an installment agreement to pay your back taxes over time.

A tax lien wont appear in your credit history, but it definitely shouldnt be ignored because it can have lasting effects on your credit and financial health. If you receive notice of a tax lien, you may wish to seek legal advice.

You May Like: How To Get Rid Of Inquiries On Your Credit Report

Tax Liens And Credit Scores

The IRS or local government will never report a tax lien directly to credit bureaus. Instead, bureaus learn of this information through public record. If a credit report registers a tax lien, it can plummet your score by 100 points or more. It can take a great deal of time to pay off your tax debts and eventually improve your credit score. Even paid liens can stay on your credit score for up to seven years. You must petition the IRS to withdraw a lien once you finish paying your debt, at which time the lien will leave your credit report.

Tax liens can be red flags for creditors, but thanks to a 2017 credit bureau initiative, you might not see a tax lien on a credit report. Starting in July 2017, the three major credit bureaus started excluding unpaid tax debts, tax liens, and court judgments from credit score reports. The bureaus agreed to remove and exclude many types of liens and civil judgments including tax liens from consumer credit reports. Now taxpayers might not have to worry as much about tax liens hurting otherwise positive credit scores.