Find Out How Bankruptcy Initially Hurts Your Credit Score But Might Help You Rebuild Credit Over The Long

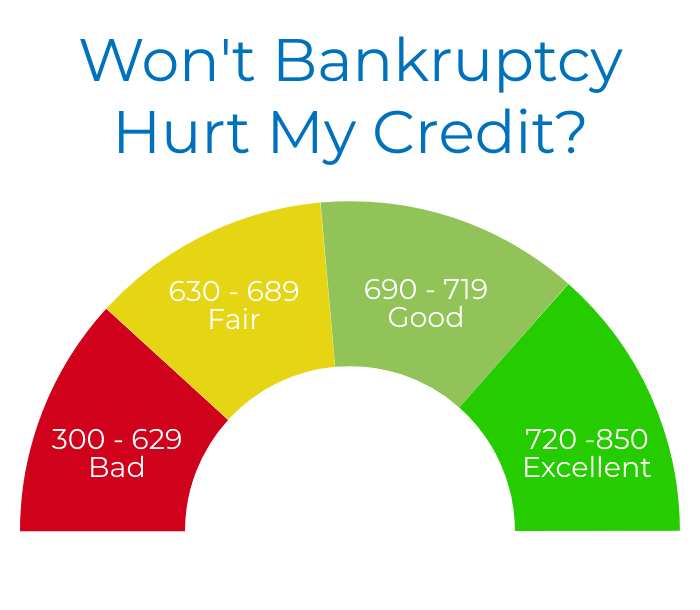

A “” is a number that supposedly summarizes your credit history and predicts the likelihood that you’ll default on a debt. Lenders use credit scores to decide whether to grant a loan and at what interest rate.

FICO scores, the most common type of credit scores, range from 300 to 850. A FICO score is based on the information in your credit report, including:

- your debt payment history

- how much debt you currently have

- your different types of credit

- how long you’ve had credit, and

- whether you have new credit.

A high FICO score generally means that you’re good at managing your finances, while a low FICO score usually means that you have been delinquent with credit payments, have high unpaid debt balances, gone through a foreclosure, filed for bankruptcy, or experienced other problems repaying debt.

If you’re struggling financially, bankruptcy can help. Bankruptcy laws were enacted to provide debtors with relief from their creditors by giving them a fresh start. This fresh start usually comes with a high price, namely, a major hit to your credit. But bankruptcy can actually help your credit in the short and long term. How much it will hurt or help you depends on your credit scores before you file , your financial circumstances, and other factors.

Effects Of Chapter 7 Bankruptcy

A successful Chapter 7 bankruptcy will be part of your report for up to ten years after it is completed. Because most of your debts will be discharged in a Chapter 7, those will actually come off your credit report even sooner. Most discharged debts drop from your credit rating after seven years. As you are waiting for the bankruptcy to drop off, you should focus on continuing to meet your obligations and meeting them on time. This is the fastest way to improve your credit rating.

How Does Bankruptcy Affect Your Credit

One of the major reasons folks put off filing for bankruptcy is that theyre afraid of how it will impact their credit score. But how does bankruptcy affect your credit? And can your credit ever recover from the hit?

Generally speaking, the answers to those questions are not as badly as you may think, and yes, you can. Below, we discuss what to expect when it comes to bankruptcy and your credit score.

Read Also: How Much Does A Loan Affect Your Credit Score

What Was Your Credit Score To Begin With

If your credit is good and you file for bankruptcy, your credit score will take a hit by a few hundred points. Several years ago, FICO released several mock scenarios showing that regardless of where your credit is at right now, your score will be reduced to around 550.

But if you have multiple accounts in collections and defaults on your credit report, your credit is probably already in the 500-600 range. So the worse your current credit rating is, the less likely you are to see your credit score severely diminished by a bankruptcy.

Quantifying The Impact Of Bankruptcy In The Context Of Personal Credit

Lets shift our attention to attempting to determine exactly how much declaring bankruptcy will change ones credit score. If you successfully declare bankruptcy in Arizona, the bankruptcy will fall under the umbrella of the payment history component of the

Specifying the exact numerical impact on credit score differs from one person to the next. The lower an individuals credit score is prior to declaring bankruptcy, the less that score will drop. The higher the individuals credit score is prior to declaring bankruptcy, the more the score will drop. It must be noted the vast majority of those who file for bankruptcy have a low credit score to start with so going bankrupt has the potential to make only a small impact on this metric of financial trustworthiness.

Don’t Miss: How Can You Check Your Credit Score For Free

How To Rebuild Your Credit Scores After Bankruptcy

Another common bankruptcy myth is the idea that you cant rebuild your credit reports or credit scores for many years after your filing. You can start working to restore your credit as soon as your bankruptcy is discharged.

Some prime creditors may not approve your application for new financing if your bankruptcy is too recent. But lenders certainly have credit products that are generally easier to qualify for, even with a discharged bankruptcy on your reports. For example:

Keep in mind that adding new, positive accounts to your credit reports is not a silver bullet. But, if you manage your new accounts responsibly, those credit cards or loans may help you offset the damage of the bankruptcy to some degree.

How Credit Scores Work

First, lets take a look at how your credit score is calculated in the first place. You have credit scores from each of the three major credit bureaus: TransUnion, Equifax, and Experian. These bureaus track all of your credit activity. That includes the use of your credit cards and whether you pay them in full, your student loans, mortgages, auto loans, and more. Each item the bureaus track is factored into your credit score, which ranges from 280 to 850.

The exact mechanism by which the bureaus arrive at an individuals credit score is proprietary they keep it secret so that, in theory, no one can game the system. However, FICO recently released some data about how much certain common events will affect your credit score, called damage points.

Your score affects your access to all sorts of things. It will show up when you want to get a credit card or a loan, for example. If you want to rent an apartment or get a cell phone plan, theyll check your credit. Some employers may even check your score when you apply for a job.

Also Check: How To Delete Collection Accounts From Credit Report

Affect My Credit Score

Of course, bankruptcyâs effect on your credit score is significant. How far your credit score will lower after filing for bankruptcy depends on your individual circumstances and credit history.

Suffice it to say that if you need to file for bankruptcy, your score is already low. That fresh financial start you get from bankruptcy will, at the end of the day, move your score in the right direction. You will need to avoid making poor financial decisions going forward, and if you file Chapter 13, you will need to adhere to the repayment plan.

How Long Does It Take For Your Credit Score To Recover After Taking A Hit

In order to understand how long it might take you personally to improve your credit, it can be helpful to look at one FICO study of the average amount of time it takes to recover your credit score back to its original number after a negative mark on your credit report.

This study was only done for mortgage payments, but its likely that itd be similar for other types of negative marks, such as paying your student loans late or having a car repossessed if you dont pay your auto loan.

| Starting credit score of 680 | Starting credit score of 720 | Starting credit score of 780 |

|---|---|---|

| 30-day late payment | ||

| 7-10 years | ||

| Note: Figures are approximations. |

In general, the longer you forgo a payment you owe, the longer itll take to recover. And the higher your credit score was to begin, the longer it will take to recover. Know that there are things you can do to prevent this from happening and to build credit in the meantime.

You May Like: Is 742 A Good Credit Score

You May Like: What Credit Score Is Needed To Get A Mortgage

Rely On Your Ohio Bankruptcy Lawyers

When bankruptcy seems like the only option, youll want to search out sound advice from reliable advisors to make the best decisions. Thiswill undoubtedly be a stressful time, but know that help is at the ready. Working with an experienced Akron bankruptcy attorney can ensure the best possible outcome and get you onthe path to recovery.

If you need help to decide whether bankruptcy is the best option for your situation, or which type of bankruptcy filing fits your situation,dont hesitate to reach out to the experts at Hausen Law, LLC our Northeast Ohio Bankruptcy Attorneys will be happy to weigh in. Give us a call at our office orcomplete anonline contact formto schedule a free consultation. We proudlyserve Akron and Canton and are here to help our community.

Will I Be Able To Get Loans Or Credit After I File For Bankruptcy

Whether you can get loans or credit immediately after bankruptcy depends on what kind of credit youre seeking.

Many bankruptcy filers are bombarded with credit card offers after the bankruptcy is over. Credit card companies know you cant file again for several years , so they might be eager for your business. But bewarethe credit card offers will likely have very high interest rates, annual fees, and other high charges.

Car loans. Most likely youll be able to get a car loan right away. But youll be dealing with subprime lenders, which means high interest rates and other unfavorable loan terms.

Mortgages. How long it will take to qualify for a mortgage depends, in large part, on the mortgage lender. You might qualify for an FHA-insured mortgage even before you complete a Chapter 13 plan and two years after a Chapter 7. For conventional loans, if your lender sells its loans to Fannie Mae, for example, youll have to wait at least two years from the discharge date after a Chapter 13 bankruptcy and four years after a Chapter 7 bankruptcy discharge or dismissal date . If your lender doesnt sell its loans to Fannie Mae, you might have to wait even longer.

These are minimum wait periodsit might take longer to qualify for a mortgage. Other factors that affect your qualification include your income, your debt load, how large your down payment will be, and more.

Also Check: What Credit Score Do You Need For Best Buy

Building Credit After Chapter 7 Bankruptcy

Most can rebuild their credit rating and have a better score than ever within 1 – 2 years after they file Chapter 7 bankruptcy. But, you canât take this for granted. To get the full benefit of your bankruptcy filing, youâll have to make an effort to improve your credit score.

Getting new credit after filing bankruptcy â itâs easier than you might think!

One of the biggest surprises for many bankruptcy filers is the amount of car loan and credit card offers they receive – often within a couple of weeks of filing their case. Itâs a lot! Why?

Filing Chapter 7 bankruptcy makes you a low credit risk

The Bankruptcy Code limits how often someone can file a bankruptcy. Once you get a Chapter 7 bankruptcy discharge, youâre not able to get another one for 8 years. Banks, credit card issuers, and other lenders know this.

They also know that, with the possible exception of your student loans, you have no unsecured debts and no monthly debt payment obligations. This tells them that you can use all of your disposable income to make monthly payments.

Beware of high interest rates.

Pay close attention to the interest rates in the new credit offers you receive. Credit card companies and car loan lenders have the upper hand here. They know you want to build your credit rating back to an excellent FICO score. And they know that youâll be willing to pay a higher interest rate than someone with perfect credit and no bankruptcy on their record.

Shop around.

Rebuilding A Credit Score After Filing For Bankruptcy

The silver lining to declaring bankruptcy is that the reduction in the filers credit score will only be temporary. This score will move back up across posterity assuming the filer does not go bankrupt once again and proactively takes the step necessary to rebuild creditworthiness. In particular, it will help to obtain secured credit cards to rebuild credit after an Arizona bankruptcy.

Everyone considering going bankrupt should be aware that it is the age of the negative information on ones credit report that determines the impact on the credit score. This means those who are patient and wait years after going bankrupt to attempt to take out a mortgage, auto loan or another sizable line of credit will have a good chance at securing that financial support. The little-known truth is that bankruptcies drop off credit reports in seven to 10 years, meaning there is minimal impact on the individuals credit score by that point in time.

Also Check: Is 784 A Good Credit Score

What Impact Does A Poor Credit Score Have On Me

Having a low credit rating impacts more aspects of your life than you might think. To start, a low credit score may prevent you from being approved for many types of financial products, including credit cards, lines of credit, personal loans, car loans, and mortgages. Even if you do qualify for one of these products, your lender may charge you a higher interest rate because your bankruptcy makes you a riskier borrower.

Beyond applying for credit products, a low credit score can prevent you from opening utility accounts that require credit check. For example, your local power company may require a credit check to open a utility account for you. If your credit score is poor, the utility provider may require a refundable deposit from you instead.

Obtaining an apartment or job could also become trickier with a poor credit score, as many landlords and employers will check your credit score during the process of verifying your application.

What Is The Credit Score Cost Of Waiting To File

While a 240-point drop is certainly worth noting, its also worth noting how much waiting to file or not filing at all can negatively impact your score.

Bankruptcy can give you a clean break from debt, which means you can focus on rebuilding. On the other hand, digging yourself out of debt can take years and lead to more damage.

- Missed payments remain on your credit report for seven years.

- Collection accounts remain for seven years from the date the original account became delinquent.

- Debts that get settled remain on your credit for seven years from the date of filing.

So, while bankruptcy will negatively affect your credit, not filing can also have a significant negative impact. And the damage can last just as long.

Talk to a debt relief specialist to see if bankruptcy is the best option for you.

Also Check: Does Aarons Report To Credit

Review Your Reports Once The Time Is Up

Once your bankruptcy has been completed and the seven- or 10-year clock has expired, review your reports again to make sure the bankruptcy was removed.

A bankruptcy should fall off your credit reports automatically, but if it doesnt, notify the credit bureaus and ask to have the bankruptcy removed and your reports updated.

Effects Of Chapter 13 Bankruptcy

With a Chapter 13 bankruptcy, both the debts and bankruptcy itself will stay on your credit report for up to seven years. Keep in mind that a Chapter 13 involves a debt repayment plan of between three and five years, so some of the debts will not be discharged until the end of the plan. Those debts will stay on your report for seven more yearspossibly longer than the bankruptcy itself.

Read Also: How To Remove Bankruptcy From Credit Report Early

Why File For Bankruptcy

Bankruptcy is a vital component of the proper functioning of the economy. There needs to be a productive way for individuals to discharge debt that has become unmanageable and cannot be repaid in full. It is meant to be a solution when all other options have been exhausted.

The federal government offers two avenues for individuals to clear and manage their debts:

Keep Any New Credit Balances Low

For any new credit accounts you open, keep the balance well below the credit limit. In comparison to your total credit limit, the amount you owe accounts for 30% of your credit score, so keeping your balances low is crucial to see a credit score increase.

If you can, aim to keep your credit card usage minimal and pay all your accounts down to zero balance each month. This responsible credit usage will almost guarantee a significant credit score increase after bankruptcy.

Recommended Reading: Do Inquiries Affect Credit Score

Late Or Missed Payments

The good news is that most payments have a 30-day grace period before they turn into a black mark. Most companies are understanding if you are infrequently a day or two late. Maybe you were waiting for your paycheck to arrive or a banking hiccup delayed the payment. Thats no big deal, as long as it doesnt happen too often.

However, if a due payment is more than 30 days late, it will show up on your credit report. And it will stay there for seven years, even if you already made sure to square up the debt. When you look at your credit report, this may appear as a mention that one or more of your accounts was 30, 60, 90, 120, 150, or 180 days past due. Obviously, the later the payment was delayed, the worse your credit score will be.