An Excellent Credit Score Is Good Enough

You don’t need a perfect credit score to get the best deals. A score of 720 or higher is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.

Thats pretty great news if you aspire to get into the group of people who have top-tier credit but you dont want to obsess over every single point in an effort to get the highest score possible.

What Counts Towards Your 900 Credit Score

In essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 900 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

Having No Credit History

If youve never borrowed money or had a credit card, you may have a blank credit report. No credit history doesnt give the best impression to lenders, and theres nothing proving that youll repay a loan on time . It can actually be just as a bad or even worse than a bad credit history and jeopardize your chances of receiving a loan when you need it.

You May Like: Aargon Agency Inc

What Is A Credit Score

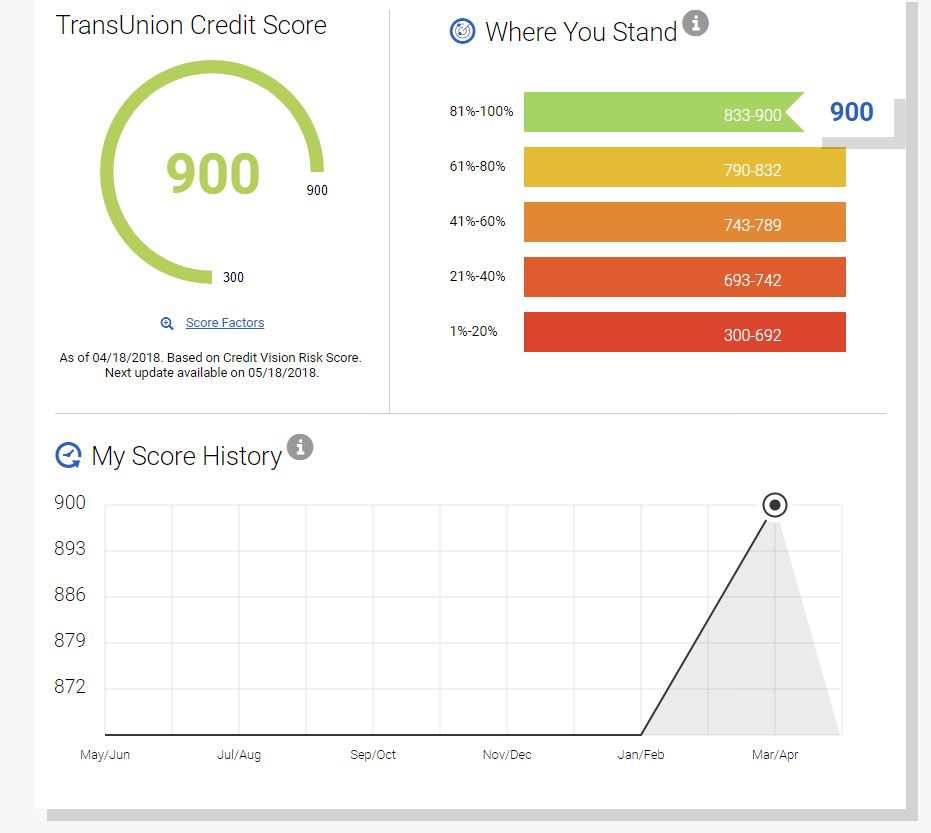

In Canada, credit scores range from 300 up to 900 points, which is the best score. According to TransUnion, 650 is the magic middle number a score above 650 will likely qualify you for a standard loan while a score under 650 will likely bring difficulty in receiving new credit.

Lenders who pull your credit bureau file may see a slightly different number than you see when you pull your own file. This is due to the fact that each creditor applies a specific set of risk rules, giving and taking points for different purposes or preferences. This proprietary method of scoring will make a difference in the final calculation. The score you pull for yourself is calculated using an algorithm created for consumers that approximates these different formulas, and should still be in the same numerical range as the lenders scores.

Order your credit report from both credit reporting agencies in Canada Equifax and TransUnion at least once per year for free , and you can pay to see your credit score if you choose.

How Much Money You Could Save By Moving To A Higher Credit Score Range

FICO provides a Loan Savings Calculator that shows how your credit score range can impact the price you pay for various loans, such as mortgages and auto loans. Sometimes, moving up even one credit score range can make a meaningful difference in both your monthly and overall cost of borrowing.

Here is a hypothetical example of the money a higher credit score range might save you on a $300,000 mortgage .

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

Benefits Of High Credit Scores

High credit scores usually come with multiple benefits, including:

- Lower interest rates. When you apply for a personal loan, mortgage, auto loan or student loan, youll have a better chance of qualifying for the best interest rate. This can save you thousands of dollars during your lifetime.

- More lending options. If you have a high score, you shouldnt have much trouble meeting any lenders minimum credit score requirements. This gives you access to lenders who only offer loan products to applicants who have excellent credit profiles.

- . Since some of the best cash back credit cards require excellent credit scores , youll most likely qualify. In addition, youll also be able to qualify for a 0% APR credit card that doesnt charge interest on purchases or balance transfers for up to 21 months.

- Lower car insurance premiums. If you live in a state that allows , you could pay a lower monthly premium.

- Lower security deposit for an apartment. When you purchase an apartment, youll probably pay less of a security deposit than someone who has a low credit score.

What Do People With Perfect Credit Scores And The Loch Ness Monster Have In Common Most People Cant Decide If They Actually Exist

While we dont know about the elusive aquatic creature in Scotland, we do know there are humans out there who have reached credit-score nirvana.

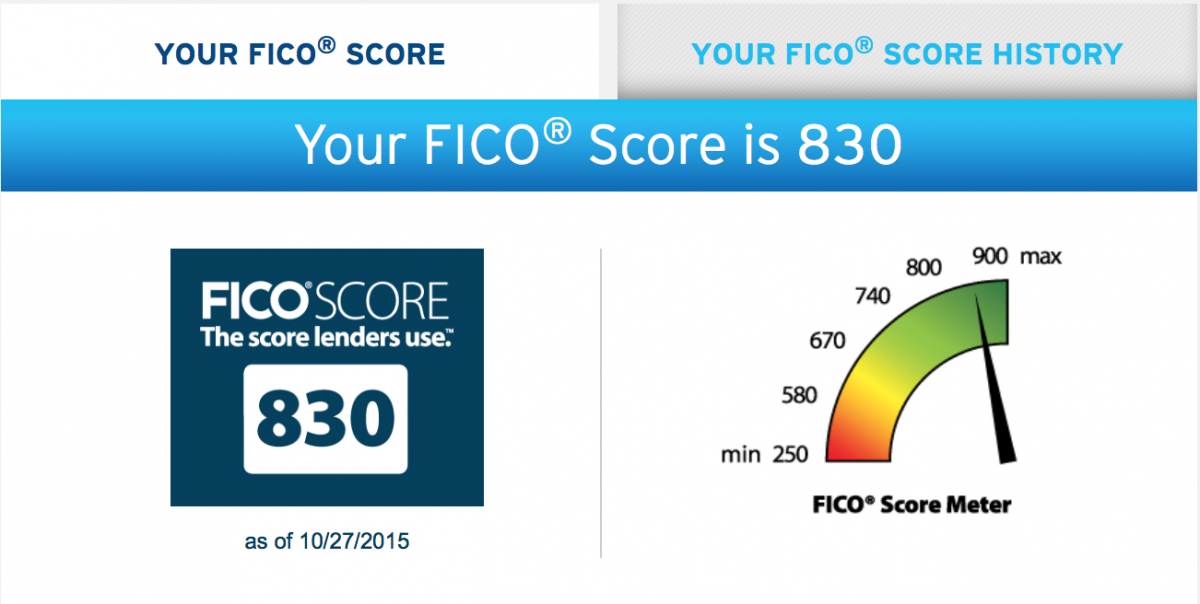

For most credit-scoring models, including VantageScore 3.0 and FICO, the highest credit score possible is 850.

We were able to speak to two Americans who belong to the exclusive FICO 850 Club: Brad Stevens of Austin, Texas, and John Ulzheimer of Atlanta. Both proudly showed off computer screenshots proving theyve reached the pinnacle of credit scoring.

Many people are skeptical that 850 is attainable. But it certainly is, says Ulzheimer, who is president of The Ulzheimer Group and a nationally recognized credit expert.

Also Check: Does Opensky Report To Credit Bureaus

They Got Their Financial Act Together Early

It takes time and financial discipline to have a top-notch credit score.

“Building credit doesn’t happen overnight,” said Heather Battison, vice president at TransUnion. “Create your own financial management process and make sure credit management is part of that process.”

People with high credit scores usually got on the right financial track as soon as they entered the real world: meaning they created a budget, were mindful of their spending and got in the habit of always paying their bills on time.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments

- going over your credit limit

- defaulting on credit agreements

- bankruptcies, insolvencies and County Court Judgements on your credit history

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

Recommended Reading: What Is Cbcinnovis On My Credit Report

Credit Score Is It Good Or Bad How To Improve Your 900 Fico Score

An 900 credit score is excellent. Before you can do anything to increase your 900 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

Different Credit Score Ranges And How They Affect You

When your credit score falls in a lower range, borrowing money can be a challenge. If you are able to qualify for financing at a lower credit score range, bad credit comes at a high cost in terms of the interest rates youll pay.

Moving up into a higher credit score range can make a meaningful difference in your financial life. Some benefits of good credit include that it could improve your chances of qualifying for the loans or credit cards you want. It may also make it easier to lease a home or apartment. And, of course, a higher credit score range could save you money in the form of lower interest rates and lower insurance premiums.

Below is a look at the different FICO Score ranges and a deeper look at the impact your credit score range might have when you apply for financing. Although these ranges apply to FICO Scores, they can be a helpful guide when evaluating your VantageScore credit scores as well.

Recommended Reading: 779 Credit Score

How To Improve Your Credit Score

If you have an average credit score or worse, its worth taking steps to improve your score over time. Heres are some moves you can make:

- Pay your bills on time every single month. Late and missed payments are the single biggest factor affecting your score.

- Lower your credit utilization. Credit utilization is measured by how much of your credit limit you use. For example, if you have a $10,000 limit and debt of $5,000, youre utilizing 50% of your available credit. If possible, aim for 30% or less overall and on individual credit cards.

- Check your credit report. You can check your credit reports from each of the three credit bureaus once a year for free through annualcreditreport.com . Reviewing your credit reports can help you spot any errors that may be having a negative impact on your score so you can take steps to correct them.

- Consider a secured card. If you have poor or bad credit, building a credit history with a secured card can be a good way to start. Choose a secured card that reports to all three credit bureaus for the best chance having your good payment behavior improve your credit standing.

Related: Should You Worry About No Credit Score?

Avoid Taking On Too Much Debt At One Time

The number of loans you take in a fixed period of time should be minimal. Repay one loan and then take another to keep your credit score from crashing. If you take multiple loans at once, it will show that you are in an unforgiving cycle where you have insufficient funds. As a result, your credit score will fall further. On the other hand, if you take a loan and repay it successfully, it will boost your credit score.

Additional Read:4 top factors that led to the growth of NBFCS in India

Don’t Miss: Is 517 A Good Credit Score

What’s The Difference Between Base Fico Scores And Industry

Base FICO Scores, such as FICO Score 8, are designed to predict the likelihood of not paying as agreed in the future on any credit obligation, whether it’s a mortgage, credit card, student loan or other credit product.

Industry-specific FICO Scores incorporate the predictive power of base FICO Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking. For example, auto lenders and credit card issuers may use a FICO Auto Score or a FICO Bankcard Score, respectively, instead of base FICO Scores.

FICO Auto Scores and FICO Bankcard Scores have these aspects in common:

- Many lenders may use these scores instead of the base FICO Score.

- It is up to each lender to determine which credit score they will use and what other financial information they will consider in their credit review process.

- The versions range from 250-900 and higher scores continue to equate to lower risk.

How Can A Low Credit Rating Affect My Life

1. Applying for a loan. Your credit score will be a big factor into the decision of whether you are approved or denied your application for more credit. Your credit score will also affect the interest rate and credit limit offered to you by the new credit grantor the lower your credit score, the higher the interest rate will be and the lower the credit limit offered the reason for this is you are considered more of a credit risk.

2. Applying for a job. A potential employer may ask your permission to check your credit file and based on what they read, they may decide not to hire you due to your poor credit history. Yes, having bad credit could cost you a job!

3. Renting a vehicle. When you sign an application to rent a car, the rental company can check your credit history to determine what their risk may be when they loan you their property. So although you are not applying for credit, the application documents you sign provide your written permission to access your credit information.

4. The same is true when applying for rental housing the landlord may assess your tenant worthiness and their risk by factoring in your credit rating and score, and they could pass you over for someone with a better credit rating.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Can You Buy A House With A 500 Credit Score

Yes, it is possible to buy a house with a 500 credit score.

A person with a 500 credit score may find it difficult to qualify for a mortgage and have to put down a large down payment, but it is still possible to get a mortgage. In order to qualify for a mortgage with a 500 credit score, you will have to be prepared to put down a large down payment.

In addition, your lender may charge you a higher interest rate, and you may be required to pay for private mortgage insurance. You will also have to show that you have a steady income and a good amount of savings in your bank account.

On top of putting more money as a down payment, another way to boost your chances of approval is to try to get a cosigner. Having a cosigner with a high credit score will help you get approved.

Jermaine Hinds Mortgage Broker Offers Personalized Solutions For Home Buyers And Homeowners

Jermaine Hinds, Mortgage Broker believes in delivering results to clients with their best rate and solutions possible. He has built his reputation around helping people and getting them mortgage financing that fits their situations for the long term. The collective knowledge and experience from Jermaine and his team will help you achieve generational wealth through real estate.

Don’t Miss: How To Remove Items From Credit Report After 7 Years

Access To A Range Of Loan Products

Lenders will practically be beating down your door to give you money if you have an excellent credit score. But beware of the risks associated with opening too many loan products, like credit cards, because it can be tempting. Make sure you dont overspend and undo your hard work in the process. Having access to these tools can be great in the event if you ever need them.

What Credit Score Is Needed To Buy A House For First Time Buyers

The higher the credit score you have, the more likely you are to get a lower mortgage interest rate. It is wise to get pre-approved on a loan before looking at houses, to ensure you can afford them. The minimum credit score for any mortgage loan will depend on your financial situation, income, assets, and debts.

Generally, a credit score above 650 has a higher chance of getting approved for a lower interest rate. The higher the credit score, the better the chance of getting lower interest rates. Lenders favour higher scores since the scores show that you keep your accounts in good standing, pay your bills on time, and use credit responsibly making the risk of the borrower defaulting, low.

Also Check: How To Get Credit Report Without Social Security Number

Is Being In The 800 Credit Score Club Really That Important

Categories

The 800 Credit Score Club is a term coined to describe those that have a of 800 or higher, as the name implies. Those who regularly monitor their credit score know how difficult it is to achieve a score this high. In fact, membership to the 800 Credit Score Club is so exclusive that roughly less than 1 in 6 people have a score high enough to be in the club. Furthermore, having a credit score between 800 to 900 is the highest credit score range and is considered to be perfect credit.

This is why all Canadians need to be monitoring their credit score.

Generally, the higher your credit score is, the better offers you will get in terms of your personal finances thereby saving you thousands of dollars over the course of your lifetime. However, given how difficult it is to get a credit score this high, is it really worthwhile to be a part of the 800 Credit Score Club?

The Ultimate Guide To Your Credit Score

9 minute read

Part of achieving financial wellness is understanding your credit score, what it means, how its calculated and learning practical strategies to improve it.

Understanding debt utilization ratio and the difference between hard checks and soft checks or between revolving credit and installment credit are just a small part of the story when it comes to seeing the full picture of your credit.

There are simple steps people can take to improve their credit score but before we explore some of those strategies, were going to look at what makes a good score, how its calculated, where you can check yours, and why it all matters.

Read Also: What Is Syncb Ppc On My Credit Report