Personal Information On Your Credit Report

The personal information included in your report is used to identify you. It contains basic information like your name, address, and place of employment. Previous addresses and employment might also be included.

Its not uncommon to have variations or misspellings of your name. Most leave these variations to maintain the link between your identity and credit information.

Having different variations of your name and old addresses won’t hurt your credit score as long as it’s actually your information. Check this section to make sure personal information is identifying you and not someone else.;

Wallethub: Best For Credit Alerts

WalletHub provides you with credit reports from TransUnion and the TransUnion VantageScore. To register, you’ll need to provide your personal details and the last four digits of your Social Security number , and you’ll have to answer a few questions to verify your identity. The site also asks other questions, such as your annual income, monthly expenses, and credit card debt to complete the registration.

The dashboard shows all of your credit accounts and balances while the credit alert section gives you a report card-style letter grade on the factors that influence your score. For example, the site warns you if your debt load is too high relative to your income or if;your is too high and hurting your score.

Drop-down menus provide additional details, such as your credit;utilization ratio. An easy-to-read version of your credit report shows all of your current and closed accounts, and any negative items, like collection accounts.

A menu bar across the top of the page provides information about financial products and services, such as checking accounts and car loans. WalletHub earns money from some of these companies, which advertise and pay for premium placements on the site.

Who Can Access My Credit Report

Your credit report is a private document and is not available for anyone in the public domain. The only people who can access your report is you and the lender to whom you apply for credit.

Your lender can access your credit report only when you have submitted an application to credit like a loan or a credit card. In no other circumstances can the lenders gain access to your credit report.

Also if you take up Credit Improvement Service, the authorized agent may access your credit report but again it will be needed to be authorized by you.

Off late, some employers also ask for credit reports to be submitted for verification, however, these will have to be provided by you. Your employer would not have access to your Credit report.

You May Like: What Is The Highest Credit Score You Can Get

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.;

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.;

What Details Would Be Mentioned In The Credit Report Of An Individual

A credit report is nothing but a reflection of the credit history of an individual. Therefore, a credit report contains details on all the aspects that affect a credit score.

A credit report would contain details of all your credit, present and past and their status. It also contains details of your repayment. Your detailed credit utilization report also makes a part of your credit report. The number of secured loans against unsecured loans can also be found in the report. The other details in the credit report would be the longest period for which you have held any credit account and the number of hard inquiries in the past 1 year against your PAN.

A credit report will also contain your basic information like name, PAN, address, phone number, etc.

You May Like: Does Paypal Working Capital Report To Credit Bureaus

What Is On A Credit Report

The short answer to that question is: A lot!

The typical credit report will include personal identifying information: a list of credit accounts , type of account , and your payment history on those accounts.

The three major credit bureaus Experian, Equifax and TransUnion compile data from sources that extend you credit. Bits and pieces of your credit history may vary slightly among the three companies because not all businesses supply information to all three agencies. However, the broad picture of your credit history should be relatively consistent.

Each credit report has four basic categories: identity, existing credit information, public records and recent inquiries.

Heres how they break down:;

Hard Pulls Vs Soft Pulls

When you apply for credit of any kind, you effectively authorize a business or individual to do what is called a hard pull or hard inquiry on your credit report. There likely will be a negative effect on your credit score from hard pulls, especially if several occur over a short period of time.

Hard pulls are another issue. Hard pulls are viewed as an indication that you need financial help to complete whatever transaction you are making, thus it has a negative effect on your credit score. The effect usually is slight, maybe 5-to-7 points, but if your credit score is on the borderline, it may drop to the wrong side of that line after a hard pull and affect the interest rate you are charged.

This should not discourage you from shopping at several lenders for auto or home loans. Fair Isaac Corporation calls this rate shopping, and allows a 45-day window where the numerous hard inquiries are treated as just one.

Don’t Miss: How Are Account Numbers Displayed In A Credit Report

Regarding Negative Information In Your Credit Report

When any negative information in your report is correct, there is only so much you can do. Correct negative information cannot be disputed. Only time can make it go away. A credit agency can report most correct negative information for seven years and bankruptcy information for up to 10 years. Information about an unpaid judgment against you can be reported until the statute of limitations runs out or up to 7 years, whichever is longer. Note that the seven-year reporting period starts from the date the delinquency took place.

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

You May Like: How To Remove Chapter 7 From Credit Report

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report.;An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before they’ll approve applications for:

- life;

- disability insurance applications.

Solutions For Credit Report Problems

It doesnt cost anything to dispute mistakes or report outdated items on your credit report. What we do know is that, if you dont do anything about errors in your report, it will likely cost you thousands of rupees in high interest rates and loan rejections. Both the credit reporting company and the information provider are responsible for correcting inaccurate or incomplete information in your report. Here are a few steps on how to fix problems in your credit report.

Pull out your credit report from the credit bureaus and carefully read through it. Carefully read through the sections containing your personal information and account information. If you find any error, like a duplicate account, or an account that isnt yours, you must take immediate step to get it corrected.

Tell the credit reporting company, in writing, what information you think is inaccurate. Include copies of any documents that support your claim. In addition to including your complete name and address, your letter should identify each item in your report that you dispute, state the reasons why you disagree with the information on the report and ask that it be removed or corrected. It makes good sense to enclose a copy of your report, with the items in question highlighted. Send your letter by certified mail and keep copies of your dispute letter and enclosures.

Also Check: How Long Does A Repossession Stay On Your Credit Report

Avoiding Credit Damage From Late Payments

Make it a point to improve your credit score. Be mindful of your spending. Try to bring your account current as soon as possible. Thirty days late is bad, but its not as bad as being 60 days late. The sooner you can catch up, the less damage to your credit health. Your credit score will start to recover as soon as you catch up to your payments.

Once you have stopped making late payments, you can save on your late fees and additional charges. Start focusing on preventing additional late payments. Follow the tips below to keep your credit score at a healthy number:

You must remember that even a single payment gets reported to the credit bureaus which will make a dent in your though you make repay the credit card bill with penalty. Hence, use your credit card diligently and make on-time payment to avoid any negative issue.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

You May Like: When Does Citi Card Report To Credit Bureaus

Lenders Look At More Than Just Your Credit Score

Banks and Non-Banking Financial Institutions are becoming better at finding out about the borrowers ability to repay a loan. They dont just see if you have a good credit rating. They will look at your debt portfolio to have an understanding of what kind of a borrower you are. They will look at your payments history to arrive at a lending decision. One thing is that if you have missed just a couple of payments, it could cause your credit score to drop drastically. Lenders know that. Hence, they carefully look at your payment history and if you have defaulted on your payment, then how many times and how late you have defaulted.

If you have bad credit, it will help if you can show that you have re-established your creditworthiness. If there was an event that caused the bad credit, then you can even try requesting a meeting with the lender to discuss your option. You can say there were hardships and provide documentation that you have since recovered from the financial hardship.

Lenders will also look at your current debt. If you dont have much debt, then this could become a strong factor in your loan application as lenders will view you favorably if you have a low debt-to-income ratio. Lenders will also want to see a recent solid repayment history with no late payments or collection accounts in the past 12 months. A low debt-to-income ratio and solid employment history is a winner in the eyes of the lender.

Monitor Your Credit Report

It is absolutely vital to monitor your credit report every quarter and dispute any inconstancies. Even a small error will cost you dearly and you might not qualify for that home you are trying to buy. Or you might end up paying hundreds of thousands of rupees more in higher interest ratesall for no mistake of yoursbut the bureaus errors. Also, identity theft is prevalent these days. It is easy for someone to lay hands on your personal information and take advantage of that. So, its essential you review all three credit reports thoroughly and address any errors. If you dont know exactly whats hurting you and what needs improvement, you can opt for a professional credit repair service. Thats an investment worth making.

If you notice that there is something incorrect listed on your credit report, you should have it corrected or removed by filing a dispute with the credit bureaus. We can help you dispute and remove negative and inaccurate items.

You May Like: Is 779 A Good Credit Score

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.;

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

You May Like: Will A Sim Only Contract Improve Credit Rating

Do Not Close Old Accounts

A considerable part of the scoring is calculated in regard to your history of credit. Attention is given to well-seasoned accounts that have been open and in good standing longer. Any credit account older than 2 to 4 years is a huge boost to your credit score. Be choosy about what kind of credit you apply for and keep it open for as long as possible, and dont close your oldest line of credit unless you absolutely have to.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Does Bluebird Report To Credit Bureaus

Are There Any Legitimate Ways To Repair Your Credit And Credit Scores

It depends. According to the Fair Credit Reporting Act you have the right to ask that the information on your credit reports be verified as accurate and not outdated. The credit bureaus have 30 days to complete the verification process or they must remove or change the information to coincide with your dispute. Credit repair companies may assist you in writing and that is something that you can do on your own, for free. It is sort of like cleaning your gutters or changing your oil. You can do it yourself for a fraction of the costthe question is, do you really want to?

From this point forward is where it gets a little fuzzy. Disputing data that you know to be accurate isnt considered a legitimate dispute. And, the credit bureaus are likely to validate it as accurate and leave it on your reports. There are no surefire methods for repairing accurate credit data that you simply dont want on your credit reports.

Beware the company or individual who guarantees that they can remove delinquencies or create a new credit report in your name. These are not legitimate practices and are illegal in most states.

Monitor Your Credit Regularly

Monitoring your scores and reports can tip you off to problems such as an overlooked payment or identity theft. It also lets you track progress on building your credit. NerdWallet offers both a;free credit report;summary and a;free credit score, updated weekly.

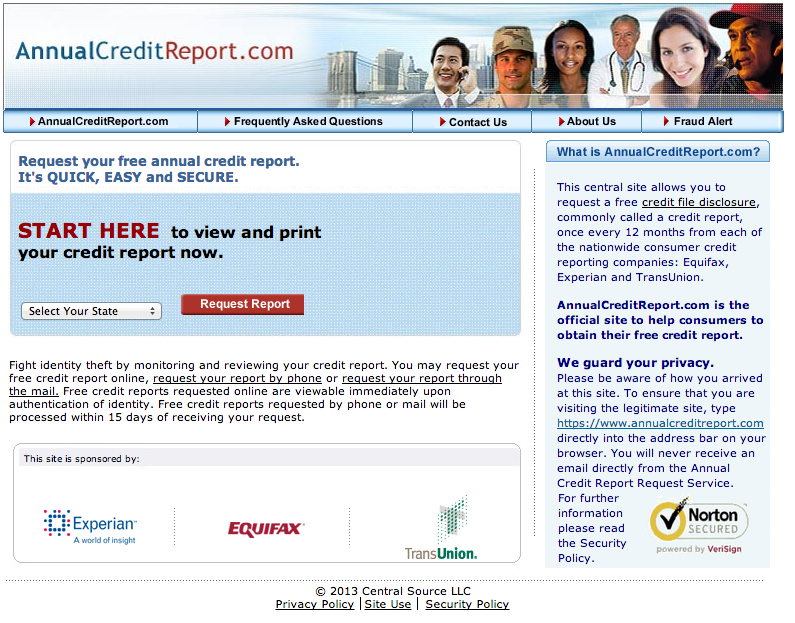

Heres how the information youll get from AnnualCreditReport.com differs from what free personal finance sites may provide:

AnnualCreditReport.com provides:

-

Data from all three major credit bureaus

-

An extensive history of your credit use

Personal finance websites, including NerdWallet, provide:

-

Unlimited access

Don’t Miss: A Credit Score Tells A Lender How

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.;

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .;

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.